Algorithmic Short Selling With Python: A Comprehensive Guide

Algorithmic short selling is a powerful trading strategy that can be used to generate profits by identifying and exploiting overvalued assets. By using a computer program to analyze market data, algorithmic short sellers can identify stocks that are trading at a price that is higher than their intrinsic value. Once a short trade has been identified, the trader can then sell the stock and wait for the price to fall. If the price does fall, the trader will profit from the difference between the sale price and the purchase price.

Algorithmic short selling is a complex strategy that requires a deep understanding of the markets and the use of sophisticated trading tools. However, it can be a very profitable strategy for those who are willing to put in the time and effort to learn it.

The first step in algorithmic short selling is to identify overvalued assets. This can be done by using a variety of fundamental and technical analysis techniques. Fundamental analysis involves looking at the financial statements of a company to assess its financial health and prospects. Technical analysis involves looking at the price and volume data of a stock to identify trends and patterns.

4.9 out of 5

| Language | : | English |

| File size | : | 10939 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 376 pages |

Once you have identified a stock that you believe is overvalued, you can then begin to develop an algorithmic trading strategy. This strategy should include the following elements:

- Entry criteria: This is the set of conditions that must be met before you will enter a short trade. For example, you may choose to enter a short trade only when the stock price is above a certain level or when the stock's moving average is in a downtrend.

- Exit criteria: This is the set of conditions that must be met before you will exit a short trade. For example, you may choose to exit a short trade when the stock price has fallen below a certain level or when the stock's moving average has turned positive.

- Risk management: This is the set of measures you will take to manage your risk when trading. For example, you may choose to set a stop-loss order to limit your potential losses or to trade only a small percentage of your portfolio.

There are a number of specific techniques that you can use to identify and execute short trades. Some of the most popular techniques include:

- Trend following: This technique involves following the trend of the market or a specific stock. When the trend is up, you will buy the stock. When the trend is down, you will sell the stock.

- Momentum trading: This technique involves buying stocks that are showing strong momentum and selling stocks that are showing weak momentum. Momentum can be measured using a variety of indicators, such as the relative strength index (RSI) or the moving average convergence divergence (MACD).

- Value investing: This technique involves buying stocks that are trading at a discount to their intrinsic value. Intrinsic value can be determined using a variety of fundamental analysis techniques, such as the discounted cash flow (DCF) model or the price-to-book (P/B) ratio.

- Technical analysis: This technique involves using historical price and volume data to identify trends and patterns in the market or a specific stock. Technical analysis can be used to identify a variety of trading opportunities, including short selling opportunities.

Algorithmic short selling is a powerful trading strategy that can be used to generate profits by identifying and exploiting overvalued assets. By using a computer program to analyze market data, algorithmic short sellers can identify stocks that are trading at a price that is higher than their intrinsic value. Once a short trade has been identified, the trader can then sell the stock and wait for the price to fall. If the price does fall, the trader will profit from the difference between the sale price and the purchase price.

Algorithmic short selling is a complex strategy that requires a deep understanding of the markets and the use of sophisticated trading tools. However, it can be a very profitable strategy for those who are willing to put in the time and effort to learn it.

4.9 out of 5

| Language | : | English |

| File size | : | 10939 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 376 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Antonia Calabrese

Antonia Calabrese David Chill

David Chill Icy Lee

Icy Lee Christopher Charlton

Christopher Charlton David Grayson

David Grayson Marcia L Tate

Marcia L Tate Kyosuke Kogure

Kyosuke Kogure John Dewey

John Dewey Ruth Padel

Ruth Padel John I Osborne

John I Osborne Amy Stewart

Amy Stewart Delia Sherman

Delia Sherman M C Roberts

M C Roberts Doman Lum

Doman Lum Sam Sykes

Sam Sykes Arda Collins

Arda Collins Nisha Vora

Nisha Vora Henry R Danielson

Henry R Danielson Yoshiaki Sukeno

Yoshiaki Sukeno Donald R Bear

Donald R Bear

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Harold PowellFollow ·2k

Harold PowellFollow ·2k Jace MitchellFollow ·18.2k

Jace MitchellFollow ·18.2k Junichiro TanizakiFollow ·15.7k

Junichiro TanizakiFollow ·15.7k Davion PowellFollow ·16.2k

Davion PowellFollow ·16.2k Martin CoxFollow ·11.9k

Martin CoxFollow ·11.9k Bobby HowardFollow ·15.2k

Bobby HowardFollow ·15.2k Jerry WardFollow ·14.1k

Jerry WardFollow ·14.1k Miguel NelsonFollow ·9.6k

Miguel NelsonFollow ·9.6k

Jesus Mitchell

Jesus MitchellThe Diabetics Menu: Your Low Carb Options

If you're living with diabetes, you may be...

Danny Simmons

Danny SimmonsThe Sam Reilly Collection: A Treasure Trove of...

In the realm of...

Vic Parker

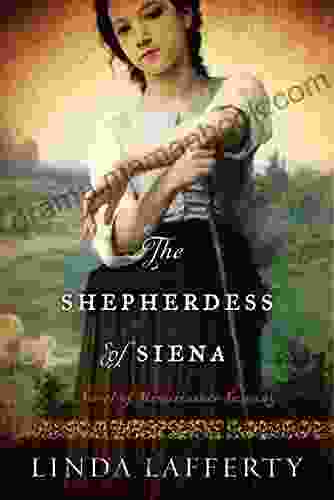

Vic ParkerThe Shepherdess of Siena: The Extraordinary Life of Saint...

Catherine of Siena, known as the...

Christian Carter

Christian CarterDive into the Mystical World of Meraki Syren: A Literary...

A Literary Odyssey Through the Depths...

Eric Hayes

Eric HayesSimplest Method on How to Remove Credit Cards from Your...

Do you have multiple credit cards...

4.9 out of 5

| Language | : | English |

| File size | : | 10939 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 376 pages |